TaxPlanIQ's Case Study Lab March 2022

Wednesday, March 2nd, 2022

Jackie Meyer and Mike Meilinger goes over 3 different case studies with students of the Tax Masterclass, providing tips and information on the best way to plan the taxes for their client(s).

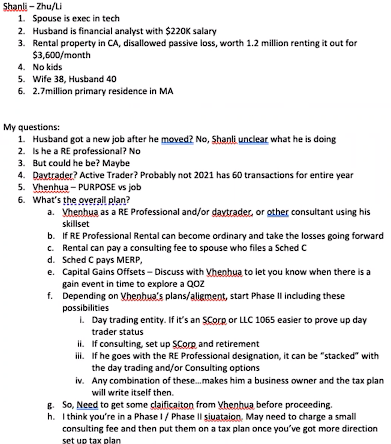

Wednesday, March 9th, 2022

Strategy: Accountable Plan/Home Office Deduction

Strategy: Cost Segregation

Strategy: Rent Home for Business Gatherings (Augusta Rule)

Strategy: Wages; Hiring Kids

New Case Study:

One Time; Phase I Implementation $5,487

Recurring: Monthly Advisory & Compliance $947

One Time: Monthly Advisory & Compliance - Year 1 ($947/8 months) $7,576

Strategy: Accountable Plan/Home Business Deduction

Strategy: Choice of Entity

Strategy: Choice of Entity

Strategy: Health/Medical Expense Reimbursement Arrangement

Strategy: Maximize Employer Retirement Match

Strategy: Misc. Business Planning Items

Strategy: Pre-Tax Benefit: 401K

Year One ROI: 309%

Year Two ROI: 370%

Wednesday, March 16th, 2022

One Time: Phase I Implementation Fee $6,875

Recurring: Monthly Advisory & Compliance $457

One Time: Monthly Advisory & Compliance - Year 1 ($457/month) $4,113

Strategy: Accountable Plan/Home Office Deduction

Strategy: Choice of Entity

Strategy: College Student Strategies

Strategy: College Student Strategies

Strategy: Roth IRA Contributions

Strategy: SEP Contributions

Strategy: Wages: Hiring Kids

Strategy: Pre-Tax Benefit: 401K

Strategy: Maximize Employer Retirement Match

Strategy: Income Shifting to Lower Tax Rate of Family Member

Year One ROI: 316%

Year Two ROI: 712%

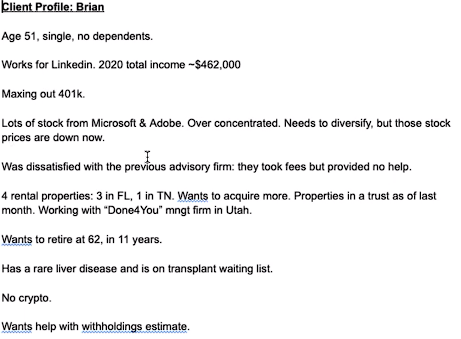

Wednesday, March 23rd, 2022

Strategy: Accountable Plan/Home Office Deduction

Strategy: Cost Segregation

Strategy: Health Savings Account (HSA)

Strategy: Health/Medical Expense Reimbursement

Strategy: Income Shifting to Lower Tax Rate of Family Member

Strategy: Qualified Opportunity Zone Reinvestment

Strategy: Charitable Planning

Strategy: Pre-Tax Benefits: Employer Benefit Package Review

Strategy: Capital Gain Offsets