Success Coach Sharla reviews tax plans

Wednesday, May 18th, 2022

Real Estate Professional

One Time: Phase I Implementation Fee $8,943

Recurring: Monthly Advisory & Fees $1,350

Recurring: Less: BK & Compliance ($850)

One Time: Advisory & Fees - Year one $8,100

One Time: Less: BK & Compliance ($5,100)

One Time: TPA - Cost Segregation $1,800

Strategy: Accountable plan/Home Office Deduction

Strategy: Cost Segregation

Strategy: Health Savings Account Optimization (HSA)

Strategy: Maximize Employer Retirement Match

ROI: 370%

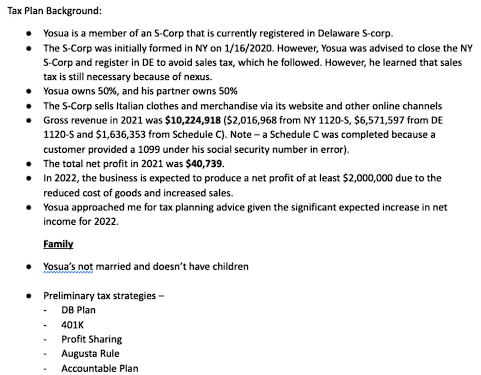

One Time: Phase I Implementation Fee $12,500

One Time: DB Plan Set up $8,000

Recurring: Monthly Advisory Fees $600

Recurring: Annual Admin Fee $521

Strategy: Accountable plan/Home Office Deduction

Strategy: Defined Benefit plan

Strategy: Health Savings Account Optimization (HSA)

Strategy: Maximize Employer Retirement Match

Strategy: Maximize Employer Retirement Match

Strategy: Minimize Self-employment (SE) Tax

Strategy: Minimize Self-employment (SE) Tax

Strategy: Pre-Tax Benefit: 401K

Strategy: Rent Home for Business Gatherings (Augusta Rule)

Year One ROI: 314%

Year Two ROI: 946%

Wednesday, May 25th, 2022

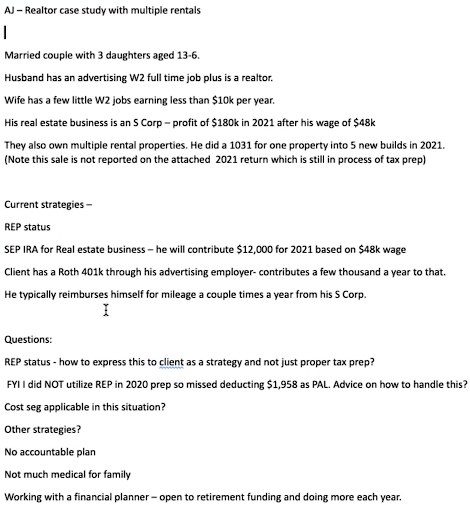

One Time: Phase I Implementation Fee $56,500

Recurring: Monthly Advisory, Planning and Compliance $750

Recurring: Yearly TPA Cost Segmentation $2,500

One Time: Monthly Advisory, Planning and Compliance $4,500

Strategy: Accountable Plan/Home Office Deduction

Strategy: Amendment for Missed Deductions

Strategy: Sep Contributions

Strategy: Wages: Hiring Kids

Strategy: Wages: Hiring Kids

Strategy: Pre-Tax Benefit: 401K

Strategy: Maximize Employer Retirement Match

Strategy: Real Estate Professional

Strategy: Cost Segregation

Strategy: Roth IRA Contributions

Year One ROI: 333%

Second Year ROI: 364%