Sharla reviews tax plans

Wednesday, September 7th, 2022

Recurring: TPA: Enhanced Retirement Plan $6,500

One Time: Phase I Implementation Fee $9,599

One Time: Monthly Advisory & Compliance Fees $4,500

Recurring: Monthly Advisory & Compliance Fees $1,500

One Time: Less Monthly Bookkeeping - Year 1 ($2,850)

Recurring: Less Monthly Bookkeeping ($950)

Strategy: Consulting Fee from C Corp to Investment LLC

Strategy: C Corp Lending Strategy

Strategy: Defined Benefit Plan

Strategy: Accountable Plan/Home Office Deduction

Strategy: Wages: Hiring Kids

Strategy: 529 Savings Plan

ROI: 325%

One Time: ERC Consulting Fees $3,500

One Time: ERC Consulting Fees $3,500

Strategy: Employee Retention Credit (ERC)

ROI: 652%

One Time: Tax plan implementation fee $15,760

Recurring: Monthly advisory & maintenance $820

One Time: Remaining maintenance 2022 $2,460

Pre Paid: Former compliance costs $1,000

Recurring: TPA: Enhanced Retirement Plan $6,500

Strategy: Charitable Donation

Strategy: Health/Medical Expense Reimbursement

Strategy: Reasonable Comp Analysis for Owners of Corporations

Strategy: Rent Home for Business Gatherings (Augusta Rule)

Strategy: Roth IRA Contributions Strategy:

Strategy: Wages: Hiring kids

Strategy: Defined Benefit Plan

Year one ROI: 675%

Year two ROI: 1024%

One Time: ERC Engagement $4,500

Strategy: Employee Retention Credit (ERC)

ROI: 1609%

Wednesday, September 14th, 2022

This lab was not recorded because of technical difficulties.

Wednesday, September 21st, 2022

One Time: Tax Plan Implementation Fee $2,149

One Time: Monthly Advisory & Compliance fee 2022 $750

One Time: Monthly Advisory & Compliance fee $250

Strategy: Accountable Plan/Home Office Deduction

Strategy: Choice of Entity

Strategy: Electric Vehicle Credits (Revised for IRA Inflation Reduction Act)

Strategy: Health Savings Account

Strategy: Health/Medical Expense Reimbursement Arrangement

Strategy: Pre-Tax Benefits Employer Benefit Package Review

Strategy: Roth IRA Contributions

Strategy: Simple IRA

Strategy: Wages: Hiring kids

ROI: 300%

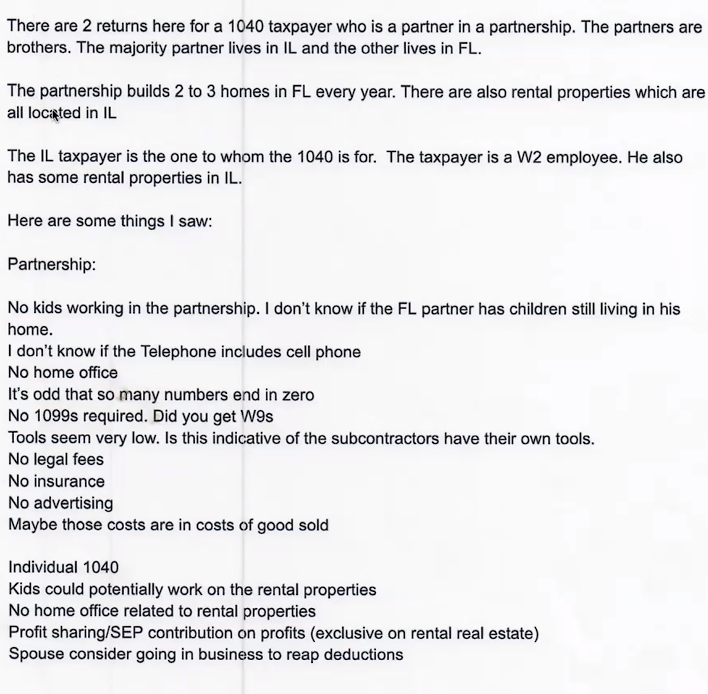

Wednesday, September 28th, 2022

Strategy: Amendment for Missed Deductions on Prior Year Return

Strategy: Amendment for Missed Deductions on Prior Year Return

Strategy: Maximize Business Deductions

Strategy: Wages: Hiring Kids

Strategy: Health/Medical Expense Reimbursement Arrangement

Defined Benefit Plan discussion if income is increased

Possible Retirement Plan for wife and or employment or wife

Tax planning for parents of college student(s)