Sharla Bartley reviews tax plans

Wednesday, June 1st, 2022

One Time: Planning and Implementation Fee $12,750

One Time: Entity Setup $500

Recurring: Yearly Ongoing Consulting and Advisory $3,582

Recurring: Monthly Ongoing Consulting and Advisory $497

Strategy: Accountable Plan/Home Office Deduction

Strategy: Backdoor Roth

Strategy: Charitable Planning

Strategy: Corporate-Owned Variable Universal Life

Strategy: Health Savings Account Optimization (HSA)

Strategy: Health/Medical Expense Reimbursement Arrangement

Strategy: Income Shifting to C Corp

Strategy: Late Penalties/Interest

Strategy: Rent Home for Business Gatherings (Augusta Rule)

ROI: 905%

Wednesday, June 8th, 2022

Class was cancelled/Sharla wasn't there, student on student discussions about previous cases and various scenarios with their clients.

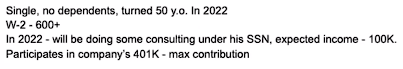

Wednesday, June 22 2022

One Time: Phase I Implementation Fee $9,657

Strategy: Accountable Plan/Home Office Deduction

Strategy: Choice of Entity

Strategy: Health Savings Account Optimization (HSA)

Strategy: Health/Medical Expense Reimbursement Arrangement

Strategy: Income Shifting to C Corp

Strategy: Pre-Tax Benefit: 401K

Strategy: SEP Contributions

Strategy: Solo 401K - Employer Contributions

ROI: 542%