Tax Strategist Sharla reviews tax plans with coaching students of yourcca.com and taxplanningmasterclass.com and TaxPlanIQ Professional Subscribers

Wednesday, July 6th, 2022

Discussion about IRA/Backdoor Roth, putting interest from properties in an LLP, and the best way to file with the information above.

Wednesday, July 13th, 2022

- We did not create a full tax return as we need to nail down entity selection. We want to make sure that the entity selection is optimized in terms maximizing retirement contributions while minimizing salaries required across their entities, as well as setting them up for a 1202, if applicable

- 1202 may not be possible because of healthcare exclusions. Tina to research using the article I sent over as a jumping-off point.

- This is the link to the Excel Org Chart I started https://www.fisher401k.com/blog/types-of-401k-profit-sharing-plans

Wednesday, July 20th, 2022

- Trust/Insurance Agency

- Wife is agent

- Husband is beneficiary of trust

- Ages 31 & 50

- Kids are 3 and 1

- Suspended RE Losses in trust

- Pretty substantial retirement contribution

- 3 Sched Cs

- Mass Mutual piece that will not ever convert to an entity $25K loss

- Brokered Insurance and Advisory Fees $444,000 - Will LIKELY convert to an entity

- Property management $8,838 Comes from spouse managing trust properties

- Capital gain - unusual item. DIY loss harvesting to get cash for house

- One personally-held rental, but they are selling in 2022. Not a previous residence

- HRA in spouse Sched C $8,000

- Already maxing a H S A

One idea is to identify which property in the trust is throwing of the most losses and sell it to be able to use those losses. Might want to do this in years of higher income

Charity

HRA in spouse Sched C $8,000

Backdoor Roth - Louise is reluctant because they both have other IRA balances

One Time: Phase I Implementation Fee $5,000

Recurring: Monthly Advisory & Compliance $500

One Time: Monthly Advisory & Compliance $3,000

Strategy: Accountable Plan/Home Office Deduction

Strategy: Backdoor Roth

Strategy: Choice of Entity

Strategy: Health/Medical Expense Reimbursement

Strategy: Maximize Employer Retirement Match

Strategy: Minimize Self-employment (SE) Tax

Strategy: Pre-Tax Benefit: 401K

Strategy: Rent Home for Business Gatherings (Augusta Rule)

Strategy: Roth IRA Contributions

Strategy: Wages: Hiring kids

Year One ROI: 340%

Year Two ROI: 461%

Wednesday, July 27th, 2022

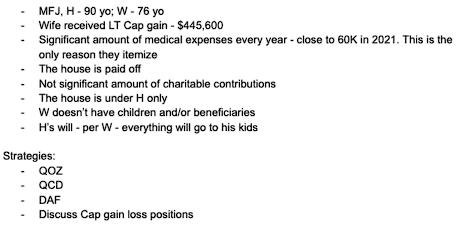

Watch this lab - it's a great case study for non-business owners

Great case study showcasing the great tax savings that can be done for non-business owners and for retirees!!

One Time: Capital Gain Strategies Planning $4,950

Strategy: Capital Gain Offsets

Strategy: Charitable Donation of Appreciated Assets

Strategy: Qualified Charitable Distributions (QCDs)

Strategy: Qualified Opportunity Zone Reinvestment

ROI: 1440%

Strategy: Accountable Plan/Home Office Deduction

Strategy: Health Savings Account optimization (HSA)

Strategy: Health/Medical Expense Reimbursement